Thai Beverage is currently trading 4 times its book value. For $0.40 per share, investors are owning $0.10 worth of their assets.

However, with the recent acquisition of F&N, Thai Beverage will be able to expand its distribution network in SEA.

Some institutions claimed that its valuations are still cheap.

Source: http://www.remisiers.org/cms_images/research/Dec10-Dec14_2012/Thai_Beverage_AmFraser_121211.pdf

I still think the valuations now are expensive but i've decided to spend a quarter of my reserves to buy Thai Beverage.

The amount of cash on hand now is crucial as the STI had hit a 1 year high. Whether it will drop or not within the next few months in 2013, it is always better to keep some spare cash in case good stocks become cheap.

This is the lesson i learned in 2011 when stock prices took a dive and i was desperate for cash as OCBC and Keppel dropped to ~$6. I did not manage to ride the wave as i was cashless at that point of time.

Monday, December 31, 2012

Saturday, December 29, 2012

GLP positioned for growth

Global Logistic Properties ("GLP") is one of the world's largest providers of modern logistics facilities, with a market-leading presence in China and Japan. It owns, manages and leases out 446 completed properties in 187 logistics parks spread across 36 major cities in China and Japan, forming an efficient logistics network with properties strategically located in key logistics hubs, industrial zones and urban distribution centres. By providing flexible solutions of Multi-tenant, Build-to-Suit and Sale and Leaseback, GLP is dedicated to improving supply chain efficiency to meet strategic expansion goals of the most dynamic manufacturers, retailers and 3rd party logistics companies in the world.

Source: http://www.channelnewsasia.com/stories/singaporebusinessnews/view/1237208/1/.html

Brazil is an emerging economy which of 2011 ranks 6th of the world's largest economies. Its economy is reliant to the export of commodities which includes, coffee, iron ore, oranges, sugar etc. Its major export partners includes US, China and Argentina.

Currency rate for Brazil remained weak as Brazil’s central bank has sold reverse currency swaps to keep the real weaker than 2 per dollar to support exporters. It sold $1.4 billion of contracts Oct. 25, $1.6 billion Oct. 23, $1.3 billion Oct. 5, $5.7 billion Sept. 12 through Sept. 17 and $350 million Aug. 21. The August reverse swaps were the first since March.

Source: http://www.glprop.com/businessModel.php

GLP had announced plans to invest US$334M to acquire assets in Brazil. Its CEO Ming Z Mei said: "We remain mindful of the global economic conditions, but are confident that our unrivalled market presence in China, Japan and now Brazil positions us well for future growth."

GLP had announced plans to invest US$334M to acquire assets in Brazil. Its CEO Ming Z Mei said: "We remain mindful of the global economic conditions, but are confident that our unrivalled market presence in China, Japan and now Brazil positions us well for future growth."

Source: http://www.channelnewsasia.com/stories/singaporebusinessnews/view/1237208/1/.html

Brazil is an emerging economy which of 2011 ranks 6th of the world's largest economies. Its economy is reliant to the export of commodities which includes, coffee, iron ore, oranges, sugar etc. Its major export partners includes US, China and Argentina.

Brazil is an emerging economy with its still weak currency which makes it an attractive place to be invested in. The acquisition from GLP could reflect gains if the Brazilian currency strengthens.

GLP with its NAV of ~$2.2 last closed at $2.74 at SGX. This stock has positioned itself for future growth and is worth a good look at.

Friday, December 28, 2012

Know what you are buying

Rowsley, a company controlled by businessman Peter Lim announced plans for a S$581 million deal that will transform Rowsley into a major real estate player.

Source: http://info.sgx.com/webcoranncatth.nsf/VwAttachments/Att_93D67C6962F8B30548257ADB001CF5C4/$file/RowsleyLtd.MediaRelease_21.12.2012.pdf?openelement

Based on the 2012-2013 half year results, Rowsley write off a net loss of about $26M and had a NAV (net asset value) of $0.0427.

It's closing price today is still at $0.295. The price to NAV ratio is about 7:1. For every $700 you invest in this stock, you are only buying $100 of its assets.

People playing contra on the stock market are heavily buying up this stock. But if you are playing it, don't expect it to maintain its upward trend since numbers have shown that it is expensive and overvalued.

Source: http://info.sgx.com/webcoranncatth.nsf/VwAttachments/Att_93D67C6962F8B30548257ADB001CF5C4/$file/RowsleyLtd.MediaRelease_21.12.2012.pdf?openelement

Based on the 2012-2013 half year results, Rowsley write off a net loss of about $26M and had a NAV (net asset value) of $0.0427.

It's closing price today is still at $0.295. The price to NAV ratio is about 7:1. For every $700 you invest in this stock, you are only buying $100 of its assets.

People playing contra on the stock market are heavily buying up this stock. But if you are playing it, don't expect it to maintain its upward trend since numbers have shown that it is expensive and overvalued.

Monday, December 24, 2012

Bangkok trip to study Thai Beverage

It was a very fruitful trip to bangkok as along the way, i did some market research on Thai Beverage.

The Chang brand in Thailand symbolizes their local brand just like Tiger Beer which signifies Tiger Beer in Singapore.

Apart from operating their beer business, they also own 89.259% of Oishi Group.

Oishi group operates a wide variety of beverages from green tea, black tea and coffee.

Its beverage business resembles Pokka.

Oishi group operates about 6 types of different Japanese restaurants in Thailand.

Oishi group distributes food to convenience stalls in Thailand

Oishi group also operates catering and food delivery services in Thailand.

Thai Beverage owns 64.66% of Serm Suk Public Company which manufactures and distributes beverages throughout Thailand.

Thai Beverage is able to utilise the wide distribution capabilities of SermSuk. Oishi Group on the other hand is able to enjoy cost efficiency by carrying Chang, est Cola beverages in its restaurants, and also widening Thai Beverage distribution network.

Thai people will continue to consume products by these companies. Thai Beverage is trying to maintain the monopoly and, recently it purchased F&N stakes in an attempt to expand the Chang beer business within Singapore and other parts of Asia.

The upward growth potential of the company is limitless. However, the current debt to equity ratio may be a worry after the acquisition of 29% F&N.

The combination of Thaibeverage, Oishi Group and Serm Suk is perfect. This is the perfect stock to invest in.

But it is not a good time to go in now because they recently took a loan from a Singapore bank.

The combination of Thaibeverage, Oishi Group and Serm Suk is perfect. This is the perfect stock to invest in.

But it is not a good time to go in now because they recently took a loan from a Singapore bank.

Friday, December 14, 2012

My lesson on Bukit Sembawang

I bought this stock last year at $4.5 and it dropped to $3.80 subsequently. I didn't know what was going on initially and thought that this stock did not perform well. After which in August this year, I decided to sell the stock because I thought it had gone back to its high of $4.77.

However, this stock did not drop further when i sold it, instead it shoot all the way up to $6.80 on last Friday 14 Dec 12's closing on SGX.

After this incident, i realised that i don't actually know what i was buying at that point of time. This 2Q2013, its Net Asset Value (NAV) went up from $3.08 last year 2Q2012 to $4.29. Its balance sheet reflected little low debts and almost 88% of its assets were made up of its share capital and reserves.

Shareholders were owning more of its assets than their company debts and thus, it reflected more value in the company followed by the rise of share price value.

Prices in private home in Singapore are not likely to go down. It is because more wealthy people from all over the world are coming here to settle down due to a number of factors like low crime, stable government, clean environment and good infrastructure transport network. (International Living 2010) "The wealthy are attracted to Singapore for its location, low taxes, clean environment and low crime; that’s why there are so many rich Chinese and Indians living there. Singapore also attracts the global wealthy, such as hedge fund managers who need a base in Asia."

My lesson on this is that as property prices go up, earnings of property holding companies are likely to go up as well.

The principal activity of the Bukit Sembawang Estates is an investment holding company whilst the principal activities of the subsidiaries are those of property development, property mortgage financing and the holding of properties and investments. The Group mostly developes landed properties around the Seletar and Sembawang areas.

Reference List

International Living. 2010. Singapore: Where Wealthy People Are Putting Their Money. [ONLINE] Available at:http://internationalliving.com/2010/08/singapore-where-wealthy-people-are-putting-their-money/. [Accessed 15 December 12].

Sunday, December 9, 2012

Market Updates

SGX

1Q2013 NAV =$6.5. Revenue reduced 4-5%. Now might not be a good time to buy in.

Extremely high borrowing costs, accompanied by strong operations/maintance costs puts SMRT in a bad shape.

Watch out for their next results. Cash flow generated from operations have to increase significantly in order to fund high borrowings from the acquisition of ~30% in F&N.

High cash generated from operations, together with less investing and financing costs puts this company in a very strong financial position. Bought in at $0.465.

Cash flow indicates a higher borrowing cost to fund its overseas expansion. If net cash generated from operations are able to cover financing and investing cost, then it may be an indicator to start buying.

Cash flow indicates more debt than earnings due to the revamp of Wisma Atria. May need to wait a while for this counter to rebound as it need more time to repay borrowings.

1Q2013 NAV =$6.5. Revenue reduced 4-5%. Now might not be a good time to buy in.

Wait till March-May period for a buy in $6.5 or below

SMRT

Thai Beverage

Silverlake Axis

The Hour Glass

Starhill Global REIT

Sunday, November 11, 2012

Investment long term vs short term

I've noticed a lot of people are having a very short term investment mind set. An example of a short term investment mind set is like when you buy a property at $100K and selling it off at $130K for example, thus making a one time gain of $30K. Or even investing $30K into commodities like silver or sugar, and hoping the value will increase 2-3 folds in the next year or two.

Seldom do i met people who actually look into a long term perspective, earning through passive recurring income monthly or yearly.

Short term investing is like betting in soccer, a 50% chance of making 100% or a 50% chance of losing 100%. The adrenaline rush to win and the greed installed in human which makes short term investment more popular than long term investment where profits may come in small numbers but consistent. Short term investing can be profitable, or can turn into losses. It is like investing blindly, hoping to win.

Long term investment, however focuses on providing long term returns on your initial investment and knowing what business to invest in is the first step. It is by looking at the type of business the company is dealing with, whether it will quarterly or yearly increase in revenue and net profits. In short is to see if the company is profitable and will continue to be is what long term investment is all about. By holding a company that will provide consistent returns will eliminate the need to monitor the performance of the investment.

That is long term investment. So are you a short term or a long term?

Tuesday, October 23, 2012

Investing in Stocks

The best thing about buying the right stocks is that you are actually owning good companies with talented individuals running them.

Tuesday, October 16, 2012

Monday, October 15, 2012

STI is up today, but is it sustainable?

From what i can see in the market today, there are a lot of liquidity flowing from overseas. If i trade currencies and know that certain currency strengthen against Singapore's, my guess will be that liquidity is most probably from that country.

From what i can see today, some stocks were up significantly. Yeo Hup Seng was from $2 previously to $6 today.

Whoever bought stocks today, don't think that just because your stock went up today, means you are right about it. The buying today seems random. Someone or somewhere's pumping money into Singapore. But no one knows from where, but when they pump it in, you are in no control as to when they will withdraw their earnings which might cause your loss.

Sunday, October 14, 2012

Last week's bargains on SGX

Singtel had been going on a pretty good price of $3.15 since Temasek decided to dispose a small percentage of it.

Last week i've noticed Singtel was bought twice by directors. I think with the current price now, it is a good buy since they managed to bid for the third time, the Barclays Premier League (BPL).

Source: http://www.todayonline.com/Hotnews/EDC121011-0000060/SingTel-scores-a-BPL-hat-trick

The next stock i wanna share with everyone is Pan United

With the fast expansion of Singapore's infrastructure, a basic building material is now the very essential material for every construction. This company is worth a look!

Friday, October 5, 2012

My Next Buy Target

4 Oct 12

ST ENGINEERING’S ELECTRONICS ARM SECURES S$166M OF RAIL ELECTRONICS AND SATELLITE COMMUNICATIONS CONTRACTS IN 3Q2012

However, it is expensive at the current price so will have to wait till it drop till $2 or below $2.

Tuesday, October 2, 2012

Another indicator of bear

Genting is disposing some of its securities.

Source: http://info.sgx.com/webcoranncatth.nsf/VwAttachments/Att_C5E0A17633347B0748257A8B003DDC89/$file/Disposal_of_Quoted_Shares.pdf?openelement

Monday, October 1, 2012

Bearish Indicators

Channelnewsasia.com (2012) states "Temasek's sale of SingTel shares came a day after it was reported to be sounding out potential buyers for its 18-per cent stake in British bank Standard Chartered worth 6 billion pounds (US$9.7 billion)."

Temasek is now selling its assets for cash at this period, when interest rates may be going up. Growth rates will slow due to rising inflation and the stock market may burst the bubble any time from now. I am investing with care and hopefully when the stock market crash, I'll have some spare cash to buy cheap assets.

Reference List

Channelnewsasia.com, Temasek to reduce stake in SingTel, viewed 01 October 2012

<http://www.channelnewsasia.com/stories/afp_singapore_business/view/1228071/1/.html>

Saturday, September 29, 2012

How to determine a Buy period

Using SGX as an example below:

This method of analysis is not a professional technical analysis but a basic analysis on the low period of this stock. However, this method may not be applicable for every stocks.

The pattern i noticed about SGX is the price is normally at its lowest in May. So if you wanna buy SGX, you can wait till May to see if the price drops to a satisfactory level.

Same method can be used to analyse the highest price period too which i see is probably in November period before issuing out their dividends.

The Hour Glass

This premier watch retail outlet sells one of the most expensive watches, with its fine exquisite design featuring only the rich. In good or bad economic situations, The Hour Glass (THG) displays a constant growth of about 5%-15% in net profits. The resilient display of its stable returns coupled with its price close to its book value. The price i bought was $1.425 and its Net Asset Value (NAV) was $1.25. I'm actually paying about 90% of its assets value.

THG brand is unique due to its careful watch brand selections and the locations of their retail store. Their retail stores are located in places which targets the most high end customers like Paragon, Marina Bay Sands. They do not want to open stores in Yishun, Woodlands or neighbourhood places which will tarnish the premier brand of the company.

They also states in their FY2011 annual reports that they will be adding more retail stores in their key markets namely Singapore, Australia. Hong Kong.

Sunday, September 23, 2012

Value Investing

Investing in SGX is all about buying low and selling high. Warren Buffet likes to pay $0.50 for a $1 worth of stock.

Value investing speaks from the true intrinsic of a company. The rate of growth the company, ultimately how the company will be valued now and in the future will determine a buy or a sell. If because of a certain decision the company makes which will increase their debts in future, and knowing that the company will have difficulty financing its debts because of bad profits or due to an stronger competitor, then you may decide to sell it or cut loss. One example is Tiger Airways which its share price dropped from $2++ to $0.70++ today due to increased competitions and high oil prices. The unfavourable position of the company makes it hard for it to grow its earnings as competitions are very stiff after the opening of Scoots, a budget airline by Singapore Airlines.

Value investing also comes from the a fundamental analysis point of view. How much risks the companies are exposed to. Airline companies in general are exposed to a constant number of risks which will affect their profits. A plane crash for example will affect huge losses for the company. An increase or a significant increase in oil prices will affect the company. A lack of a minimum required number of passengers in flights, meaning less people want to travel to a country that is part of the airline routes. There are so many factors which will affect the profitability of airlines company. A company that makes more sense in value investing is a company like SIA Engineering (SIAEC) who has a monopoly in its way. Of cause there are much more companies that have the same fundamentals which include Vicom, Singapore Exchange (SGX), Singapore Pools (but is not listed in SGX), ERP (also not listed in SGX). How SIAEC makes money is from the number of airlines landing is Changi Airport per day basis. Because all the airlines need to undergo overhaul operations and maintenance before making the next flight. These airlines have to go through SIA engineering's Overhaul and Maintanance hangars to service their airlines. And thus, SIA Engineering is the monopoly of the overhaul business in Changi Airport. As the number of airlines landing in Changi increases with the completion of Terminal 4, SIA engineering (SIAEC) will grow in terms of profits. As long as airline numbers landing in Changi Airport increases, will benefit the growth of SIA engineering. Inflation will also cause maintenance cost to increase and that will also contribute to SIAEC earnings. In value investing, we look at the factors that will affect the profits of SIAEC. If we know that the airlines traffic numbers are likely to increase, maintenance prices are going up, and SIAEC's stock price had gone down quite a bit, then we know that it is time to buy SIAEC.

Wednesday, September 19, 2012

I'm selling Thai Beverage

Thai Beverage had gone up a lot, and based on its current price of $0.39 per share. It is only yielding ~3% dividend.

And furthermore, it is buying off F&N at an expensive price previously to compete with Dutch Brewer, Heineken.

As an fundamental analysis, InvestingSGX.blogspot.sg will recommend a sell on this stock!

Tuesday, September 18, 2012

My opinion on QE3

Since QE3 will bring up inflation due to dilution of cash in the economy. One reason i can think of is china, which kept its currency low to boost exports despite US claims that they are manipulating the currency.

Firstly, China did not appreciate their currency. US can print more money to buy their assets. And these assets will be come a discounts because it is bought by money being created out of nothing.

Secondly, QE3 is targeting more towards China based on the recent US trade claims against them. These claims, according to Kennedy, G (2012) states that "Chinese government has subsidized its automotive export industry in a way that is not allowed under World Trade Organization rules. As a result of the move, China filed a complaint with the WTO against a new U.S. law aimed at combating China's subsidies. The move is called "Countervailing duties" and includes tariffs on tires and steel."

My take on these were the claims may not be strong enough against China , and therefore decided that an alternative as to be in place. The Quantitative Easing 3, probably to flood China economy with cheap money.

My take on these were the claims may not be strong enough against China , and therefore decided that an alternative as to be in place. The Quantitative Easing 3, probably to flood China economy with cheap money.

Reference List

George Kennedy 2012, Obama calls for trade case against China, viewed 19 September 2012

< http://www.autoblog.com/2012/09/18/obama-calls-for-trade-case-against-china/>

George Kennedy 2012, Obama calls for trade case against China, viewed 19 September 2012

< http://www.autoblog.com/2012/09/18/obama-calls-for-trade-case-against-china/>

Anthony Shoemaker 2012, China is ‘unfairly keeping its currency low,’ U.S. Rep. Turner says, viewed 19 September 2012

<http://www.daytondailynews.com/blogs/content/sharedgen/blogs/dayton/ohiopolitics/entries/2012/01/12/china_is_unfairly_keeping_its.html/>

<http://www.daytondailynews.com/blogs/content/sharedgen/blogs/dayton/ohiopolitics/entries/2012/01/12/china_is_unfairly_keeping_its.html/>

Monday, September 17, 2012

3 REITS for sustainable risks and returns

When the US Fed Reserve Chairman announced QE3, i'm still wondering what will happen in the financial world and how it will impact the markets.

Snyder, M (2012) says, "This time, the quantitative easing is going to be open-ended. The Fed is going to buy 40 billion dollars worth of mortgage-backed securities per month until they have decided that the economy is in good enough shape to stop."

Inflation rates will go up as the US floods the world with more money. Singapore, like other countries, have to protect itself by strengthening its currency. And it has to be well managed because if our currency becomes too strong, it will affect our export rates as our prices will become expensive for other countries to import our goods. Therefore, QE3 will still cause our inflation rates to rise, but probably at a slower rate.

In order to curb inflation, we can hold assets like properties, commodities and stocks which is not affected by export numbers.

Focusing on 3 REITS which i particularly like because of their presence in Singapore

Starhill Global - owner of Wisma Atria and Ngee Ann City retail and offices in Central

CapitalMall Trust - owner/leader of the malls located in different parts of Singapore located n Bugis, Sembawang, Orchard, Clark Quay, Jurong.

More info of its portfolio: http://www.capitamall.com/our_portfolio/portfolio_overview.html

CDL Hospitality Trust - owns Orchard Hotel, Grand Copthorne Waterfront Hotel, M Hotel, Copthorne King’s Hotel, Studio M Hotel, Novotel Singapore Clarke Quay.

Starhill Gobal yields about 7% for $0.75 per share

CapitalMall Trust - yields 5.7% for $1.985 per share

CDL HT - yields 5.4% for $1.965 per share

Reference List

Michael Snyder 2012, QE3: Helicopter Ben Bernanke Makes It Rain Money, viewed 18 September 2012

< http://world.hawaiinewsdaily.com/2012/09/qe3-helicopter-ben-bernanke-makes-it-rain-money/>

Snyder, M (2012) says, "This time, the quantitative easing is going to be open-ended. The Fed is going to buy 40 billion dollars worth of mortgage-backed securities per month until they have decided that the economy is in good enough shape to stop."

Inflation rates will go up as the US floods the world with more money. Singapore, like other countries, have to protect itself by strengthening its currency. And it has to be well managed because if our currency becomes too strong, it will affect our export rates as our prices will become expensive for other countries to import our goods. Therefore, QE3 will still cause our inflation rates to rise, but probably at a slower rate.

In order to curb inflation, we can hold assets like properties, commodities and stocks which is not affected by export numbers.

Focusing on 3 REITS which i particularly like because of their presence in Singapore

Starhill Global - owner of Wisma Atria and Ngee Ann City retail and offices in Central

CapitalMall Trust - owner/leader of the malls located in different parts of Singapore located n Bugis, Sembawang, Orchard, Clark Quay, Jurong.

More info of its portfolio: http://www.capitamall.com/our_portfolio/portfolio_overview.html

CDL Hospitality Trust - owns Orchard Hotel, Grand Copthorne Waterfront Hotel, M Hotel, Copthorne King’s Hotel, Studio M Hotel, Novotel Singapore Clarke Quay.

Starhill Gobal yields about 7% for $0.75 per share

CapitalMall Trust - yields 5.7% for $1.985 per share

CDL HT - yields 5.4% for $1.965 per share

Reference List

Michael Snyder 2012, QE3: Helicopter Ben Bernanke Makes It Rain Money, viewed 18 September 2012

< http://world.hawaiinewsdaily.com/2012/09/qe3-helicopter-ben-bernanke-makes-it-rain-money/>

Thursday, September 13, 2012

REITS, an appreciating gem in Singapore

Blackden, R (2012) says "Federal Reserve chairman Ben Bernanke has announced a third round of quantitative easing in a bid to help America's weakening economy, as the IMF warns that Greece will need a third bail-out. America's central bank said it will purchase $40bn (£25bn) of mortgage-backed bonds a month to stimulate the housing market and keep long-term interest rates low."

US is slowly recovering as they are now purchasing back their debts. However the Euro Crisis will need a longer time to be resolved as the IMF warns of the third bail-out of Greece as stated by Blackden, R (2012).

The odds of the third bail-out is unknown, but if it happens, stocks will continue to go on the upward trend as inflation rates increases.

The rationale for the upward trend of stocks is because when more liquidity is injected into the Greece economy, the liquidity will flow into countries with good returns and stable economy. Singapore is one example of a stable country with AAA rating by Standard and Poor.

REITS in Singapore had been the best performing assets. If you do not have enough money to buy property assets which was likely to be an uptrend in singapore for the next 5 years due to land constraints, you can invest in REITs in Singapore for good returns.

Some of the REITS:

- Starhill Global

- CapitalMall Trust

Few types of REITS to look at

- Commercial Warehouses / Factories

- Retail

- Hotels

- Residences

- Offices

Reference List

Richard Blackden 2012, Federal Reserve announces QE3 to aid US recovery, viewed 14 September 2012

< http://www.telegraph.co.uk/finance/economics/9541857/Federal-Reserve-announces-QE3-to-aid-US-recovery.html>

Richard Blackden 2012, Federal Reserve announces QE3 to aid US recovery, viewed 14 September 2012

< http://www.telegraph.co.uk/finance/economics/9541857/Federal-Reserve-announces-QE3-to-aid-US-recovery.html>

Friday, September 7, 2012

Why i think China Stocks will go up

China stocks did not perform very well in SGX for the previous years. I hold a couple of them which up till now seen its value depreciate up to 30% in value as compared to the price i bought it for.

My uncle, who is a CFO of an SME company told me that China companies generally have two different types of accounting standards, one for the public's view and the other one for their own management which was not shown to the public. Because of the lack of trust for china companies, many of the investors prefer to stay away from them.

However, i ignored the negative sentiments for them and went in to buy a few of the china stocks, hoping that they will be part of the China's 10 year growth plan, and appreciate in value in future.

These are the few stocks that i own namely Midas, which business is providing steel related products for the railway sector. Another stock i own is Hu An Cable, which deal with cable products etc electrical wires.

I believe that these two companies are well positioned to tap the expansion plans from the chinese government. Both Midas and Hu An had been constantly winning contracts from the government to build railway trains, extend electric cables along the china provinces.

Below is a news that China had started its expansion plans.

Wang, J (2012) says, "China approved plans to build 2,018 kilometers (1,254 miles) of roads, spurring the biggest stock- market rally in almost eight months on signs the government is stepping up stimulus efforts to revive economic growth.

The government also backed nine sewage-treatment plants, five port and warehouse projects, and two waterway upgrades, according to statements on the website of the National Development and Reform Commission yesterday. No investment amounts were given."

Midas and Hu An Cable went up slightly today. But in the long run, it is still uncertain whether investors will start regaining confidence on chinese stocks. But i am sure that the contracts they won will contribute positively to their revenue at least by end of 2013.

Reference List

Jasmine Wang 2012, China’s Roads-to-Subways Construction Spurs Stocks Rally, viewed 7 September 2012

< http://www.bloomberg.com/news/2012-09-06/china-approves-plan-to-build-new-roads-to-boost-economy.html>

My uncle, who is a CFO of an SME company told me that China companies generally have two different types of accounting standards, one for the public's view and the other one for their own management which was not shown to the public. Because of the lack of trust for china companies, many of the investors prefer to stay away from them.

However, i ignored the negative sentiments for them and went in to buy a few of the china stocks, hoping that they will be part of the China's 10 year growth plan, and appreciate in value in future.

These are the few stocks that i own namely Midas, which business is providing steel related products for the railway sector. Another stock i own is Hu An Cable, which deal with cable products etc electrical wires.

I believe that these two companies are well positioned to tap the expansion plans from the chinese government. Both Midas and Hu An had been constantly winning contracts from the government to build railway trains, extend electric cables along the china provinces.

Below is a news that China had started its expansion plans.

Wang, J (2012) says, "China approved plans to build 2,018 kilometers (1,254 miles) of roads, spurring the biggest stock- market rally in almost eight months on signs the government is stepping up stimulus efforts to revive economic growth.

The government also backed nine sewage-treatment plants, five port and warehouse projects, and two waterway upgrades, according to statements on the website of the National Development and Reform Commission yesterday. No investment amounts were given."

Midas and Hu An Cable went up slightly today. But in the long run, it is still uncertain whether investors will start regaining confidence on chinese stocks. But i am sure that the contracts they won will contribute positively to their revenue at least by end of 2013.

Reference List

Jasmine Wang 2012, China’s Roads-to-Subways Construction Spurs Stocks Rally, viewed 7 September 2012

< http://www.bloomberg.com/news/2012-09-06/china-approves-plan-to-build-new-roads-to-boost-economy.html>

Saturday, September 1, 2012

Blindspot

Why i named this topic blindspot is because this company was here for a long time but because of the market noises, i was not able to discover this gem until i read these blogs from two wisemen. Refer to the reference list below

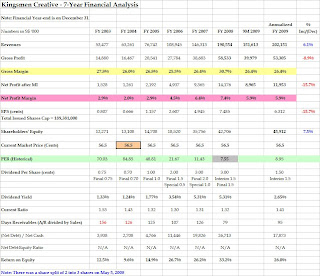

One of the blogs i read was a person who is a long term investor of Kingsmen Creative. Below is what he gathered from the 2012 AGM.

financiallyfreenow (2012) says

Reference List

CNBC with Wires, 2008, Lehman Brothers Files For Bankruptcy, Scrambles to Sell Key Business, viewed 2 September 2012

<http://www.cnbc.com/id/26708143/Lehman_Brothers_Files_For_Bankruptcy_Scrambles_to_Sell_Key_Business>

sgmusicwhiz 2012, Kingsmen Creatives Analysis of Purchase, viewed 2 September 2012

<http://sgmusicwhiz.blogspot.sg/2010/03/kingsmen-creatives-analysis-of-purchase.html>

financiallyfreenow 2012, Kingsmen Investment Fair 2012, viewed 2 September 2012

<http://financiallyfreenow.wordpress.com/2012/05/19/kingsmen-annual-general-meeting-fy-2011/>

One of the blogs i read was a person who is a long term investor of Kingsmen Creative. Below is what he gathered from the 2012 AGM.

financiallyfreenow (2012) says

- "One shareholder asked about the competitors of Kingsmen. Benedict Soh, the co-founder and Executive Chairman, said that the competitors vary for each division. He also said something very significant. He said that Hans Bruder, Managing Director of Octanorm, told him, “No other company in the world has the same breadth of services as Kingsmen”. I felt elated at hearing this. Ben joked that now he has someone to quote instead of him always saying that Kingsmen is a strong company.

- 70% of Kingsmen’s clients are repeat customers. Ben said that clients come back to Kingsmen just like how patients always visit the same family doctor for illnesses. Word-of-mouth recommendations have also helped Kingsmen’s business.

- Revenue contributions from Singapore takes a huge percentage of total revenue. Many of the projects done overseas are still billed in Singapore as the Singaporean teams are involved in the project overseas even though the clients are overseas clients."

These 3 points indicate that Kingsmen business is fundamentally sound, meaning to say that their business is resilient to competitions but does not mean that they are not exposed to competitions at all. I do not have a very detailed overview of this company but based on the numbers from recent years, the company had substantially grew their revenue at a steady pace. Next is the quote from sgmusicwhiz, who is also believes greatly in its strong business fundamentals.

sgmusicwhiz (2012) says "Kingsmen’s revenues have seen a steady rise from S$53.5 million in FY 2003 to a high of S$190.6 million in FY 2008, in just a span of 5 years. 9M 2009 revenues were S$151.6 million, and as 4Q is traditionally their strongest quarter, the FY 2009 results may yet surprise on the upside."

CNBC with Wires (2008) says "Financial institutions globally have recorded more than $500 billion of write-downs and credit losses as the U.S. subprime mortgage crisis has spread to other markets." with context to the Lehman Brothers bankruptcy issue caused global investors worldwide to lose confidence, meaning to start withdrawing out money from their investments from bonds, equities, banks etc. This in turn caused a market turmoil. Investors worldwide being fearful, decided to stop spending/investing and soon more and more businesses got affected.

However, if you look closely at the earnings from Kingsmen Creative at the 2008-2009 mark during the turmoil, their revenue was not at all affected. This shows that the company is resilient because it is able to deliver earnings with the presence of an economic crisis.

Now with the Price to Earning(PE) ratio of ~9 is still a cheap buy for this stock.

CNBC with Wires (2008) says "Financial institutions globally have recorded more than $500 billion of write-downs and credit losses as the U.S. subprime mortgage crisis has spread to other markets." with context to the Lehman Brothers bankruptcy issue caused global investors worldwide to lose confidence, meaning to start withdrawing out money from their investments from bonds, equities, banks etc. This in turn caused a market turmoil. Investors worldwide being fearful, decided to stop spending/investing and soon more and more businesses got affected.

However, if you look closely at the earnings from Kingsmen Creative at the 2008-2009 mark during the turmoil, their revenue was not at all affected. This shows that the company is resilient because it is able to deliver earnings with the presence of an economic crisis.

Now with the Price to Earning(PE) ratio of ~9 is still a cheap buy for this stock.

Reference List

CNBC with Wires, 2008, Lehman Brothers Files For Bankruptcy, Scrambles to Sell Key Business, viewed 2 September 2012

<http://www.cnbc.com/id/26708143/Lehman_Brothers_Files_For_Bankruptcy_Scrambles_to_Sell_Key_Business>

sgmusicwhiz 2012, Kingsmen Creatives Analysis of Purchase, viewed 2 September 2012

<http://sgmusicwhiz.blogspot.sg/2010/03/kingsmen-creatives-analysis-of-purchase.html>

financiallyfreenow 2012, Kingsmen Investment Fair 2012, viewed 2 September 2012

<http://financiallyfreenow.wordpress.com/2012/05/19/kingsmen-annual-general-meeting-fy-2011/>

Thursday, August 30, 2012

More indications of Tourism Bloom in Singapore

Lim (2012) stated that "Both Singapore and China are hoping the Giant Pandas can fly to Singapore by the end of the year."

On the other hand, with the completion of the new Terminal 4, SATS will most likely be the main operator for their gateway services. SATS core business includes gateway services and food solutions. As the operator of the new Passenger Cruise Terminal, they are in a good position to capture the tourism bloom in the next 5 years.

On the other hand, with the completion of the new Terminal 4, SATS will most likely be the main operator for their gateway services. SATS core business includes gateway services and food solutions. As the operator of the new Passenger Cruise Terminal, they are in a good position to capture the tourism bloom in the next 5 years.

Another GEM that i missed out is Genting Singapore, previously turning a 2Billion in debt 2-3 years ago into 0.5M in cash.

LEISURE & ENTERTAINMENT (2012) states that "The construction hindered Genting from aggressively pushing the new Equarius and Beach Villas." The completion of the Marine Life Park will attract more people to the luxury tourist accomodations. Genting Singapore will definitely benefit from the Tourism Bloom in the next 5 years as well.

Reference List

Lim, K 2012, Pandas' arrival from China set for year-end, viewed 31 August 2012

<http://www.channelnewsasia.com/stories/singaporelocalnews/view/1201688/1/.html >.

Reference List

Lim, K 2012, Pandas' arrival from China set for year-end, viewed 31 August 2012

<http://www.channelnewsasia.com/stories/singaporelocalnews/view/1201688/1/.html >.

LEISURE & ENTERTAINMENT 2012, See how Marine Life Park's construction screwed Genting's new VIP products,

LEISURE & ENTERTAINMENT , Singapore, viewed 31st August 2012,

< http://sbr.com.sg/leisure-entertainment/news/see-how-marine-life-parks-construction-screwed-gentings-new-vip-products>.

< http://sbr.com.sg/leisure-entertainment/news/see-how-marine-life-parks-construction-screwed-gentings-new-vip-products>.

Attracting more Foreign investments to Singapore

Two articles to share

Singapore Bonds Beat Peers In Shrinking AAA Pool: Southeast AsiaThe securities are poised to return 11 percent this year on aU.S.-dollar basis, compared with a 0.9 percent advance for developed markets including Australia, Canada and the U.S., according to indexes compiled by Bank of America Merrill Lynch. The Singapore dollar has strengthened against 14 of its 16 major counterparts this year as the island’s central bank said in April it will allow faster gains to curb inflation.

Singapore Bonds Beat Peers In Shrinking AAA Pool: Southeast Asia, para 2

<http://www.bloomberg.com/news/2012-08-30/uob-fund-return-beats-peers-with-perpetual-debt-southeast-asia.html>

UOB Fund Return Beats Peers With Perpetual Debt: Southeast Asia

UOB Asset Management Ltd.’s Singapore dollar debt fund is beating most peers by buying perpetual bonds and investing 70 percent of its money overseas as rates on bank deposits and sovereign yields approach zero.

UOB Fund Return Beats Peers With Perpetual Debt: Southeast Asia, para 1

Sunday, August 26, 2012

3 long-term stocks to hold

SIA Engineering. Why?

Why SATS?

Raffles Medical

patients from all over the world. Patients from

Indochina saw a significant increase. Patient

visits from the Middle East saw a double

digit increase, and many of them sought

treatment for complex medical conditions

at Raffles Medical. Strong and effective marketing

efforts through patient referral networks,

international insurers, medical evacuation

companies, overseas liaison offices and

associates contributed to the growth.

Taken from: Raffles Medical Annual Report 2011.

Why Raffles Medical

Many patients are willing to travel from overseas to singapore to seek quality healthcare from Raffles. This proves its marketing and branding success of the company.

The company grows ~10% despite the Europe Debt Crisis that is slowing the growth in the Asian economies.

Taken from: Raffles Medical Annual Report 2011.

- SIA Engineering Secures MRO Contract for Scoot B777 Fleet

- Previously mentioned the construction plans for the new Changi Terminal 4 which will accomodating 16M passengers a year as compared to the previous budget terminal which handled 4.6M passengers in 2011.

Why SATS?

- To operate the new cruise Passenger Terminal

Raffles Medical

- Travelling miles for trusted care

patients from all over the world. Patients from

Indochina saw a significant increase. Patient

visits from the Middle East saw a double

digit increase, and many of them sought

treatment for complex medical conditions

at Raffles Medical. Strong and effective marketing

efforts through patient referral networks,

international insurers, medical evacuation

companies, overseas liaison offices and

associates contributed to the growth.

Taken from: Raffles Medical Annual Report 2011.

Why Raffles Medical

Many patients are willing to travel from overseas to singapore to seek quality healthcare from Raffles. This proves its marketing and branding success of the company.

The company grows ~10% despite the Europe Debt Crisis that is slowing the growth in the Asian economies.

Taken from: Raffles Medical Annual Report 2011.

3 reasons for Tourism Boom in Singapore

Here is 3 reasons why:

Opening of the Gardens By the Bay - 29 Jun 12:

Source: http://www.relax.com.sg/relax/news/1176948/Gardens_by_the_Bay_A_new_icon_for_Singapore.html

Opening of the new Passenger Cruise Terminal in Marina - 26 May 12:

Source: http://www.relax.com.sg/relax/news/1119546/Singapore_eyes_Asia_cruise_market_with_new_terminal.html

Changi Terminal 4 to be completed in 2017:

Source: http://www.channelnewsasia.com/stories/singaporelocalnews/view/1186306/1/.html

Opening of the Gardens By the Bay - 29 Jun 12:

Source: http://www.relax.com.sg/relax/news/1176948/Gardens_by_the_Bay_A_new_icon_for_Singapore.html

Opening of the new Passenger Cruise Terminal in Marina - 26 May 12:

Source: http://www.relax.com.sg/relax/news/1119546/Singapore_eyes_Asia_cruise_market_with_new_terminal.html

Changi Terminal 4 to be completed in 2017:

Source: http://www.channelnewsasia.com/stories/singaporelocalnews/view/1186306/1/.html

Monday, August 6, 2012

How i look at stock market

Let me bring you back to the period of Apr this year. The "ultra low cost financing" from ECB to the rest of the European banks which to me means the printing of about 1 trillion euros.

Source: http://money.cnn.com/2012/04/19/markets/ecb-euro-financing/index.htm

Some of these money as indicated by the source went back to the government bonds. The rest of the money will flow to Asia and the other parts of the world.

My previous study of Foreign Direct Investments (FDI):

Source: http://investingsgx.blogspot.sg/2012/05/fdi-in-singapore-global-recession.html

My assessment of the cash injection will impact the markets in approx. 1 year. The injection in April this year will likely cause stock markets going at an uptrend from Nov 12 to Apr 13.

When the stock markets are high may mean 2 things.

Source: http://money.cnn.com/2012/04/19/markets/ecb-euro-financing/index.htm

Some of these money as indicated by the source went back to the government bonds. The rest of the money will flow to Asia and the other parts of the world.

My previous study of Foreign Direct Investments (FDI):

Source: http://investingsgx.blogspot.sg/2012/05/fdi-in-singapore-global-recession.html

My assessment of the cash injection will impact the markets in approx. 1 year. The injection in April this year will likely cause stock markets going at an uptrend from Nov 12 to Apr 13.

When the stock markets are high may mean 2 things.

- The liquidity/FDI hit the asian markets or ...

- Inflation rises, therefore causing market prices to rise

However, in the long run, markets are not likely to stay bad forever. Here are two examples of why:

- Asia Buyers Snap Up Australian Hotels As Mining Boom Fills Rooms. Source: http://www.bloomberg.com/news/2012-08-06/asia-buyers-snap-up-australian-hotels-as-mining-boom-fills-rooms.html

- Movement in the Breweries sector, F&N( Fraser and Neave), Thai Beverage, Heineken and APB( Asian Pacific Breweries). Source: http://business.asiaone.com/Business/News/Story/A1Story20120804-363352.html

Companies / Sovereign Weath Funds are still buying up assets around the world. There are still cheap bargains out there waiting to be bought.

Friday, July 13, 2012

Blue Chip Stocks are up

Bullish on Aviation Overhaul Companies

Singapore Telecommunications went up from 3.12 to 3.4 in about 2 weeks.

Singapore Telecommunications went up from 3.12 to 3.4 in about 2 weeks.

Sunday, July 8, 2012

China Stocks going up in Nov 12

China forcasts their GDP growth to about 8% this year. However their growth in Q1 is only 1.8%. Therefore for the rest of the year, they have to grow about 6.2% more.

The first time they cut their interest rate was from ~6.5% to 6.~6.31%.

The second time they cut further from ~6.31% to ~6%.

China cuts interest rates for the second time in a month

http://www.bloomberg.com/video/china-cuts-rates-for-second-time-in-a-month-neObpBcOQv2O09xvh4CVxA.html

With the cut in interest rates, more companies will start borrowing to expand their businesses. There will definitely be a slowdown in growth in the China economy. However, my view is that in November, china stocks will start to see the effect of the reduced interest rates.

Companies may see more contracts coming in, and old customers being able to pay up for existing contracts.

One example:

Hu An Cable clinches RMB101.3 million contract

The first time they cut their interest rate was from ~6.5% to 6.~6.31%.

The second time they cut further from ~6.31% to ~6%.

China cuts interest rates for the second time in a month

http://www.bloomberg.com/video/china-cuts-rates-for-second-time-in-a-month-neObpBcOQv2O09xvh4CVxA.html

With the cut in interest rates, more companies will start borrowing to expand their businesses. There will definitely be a slowdown in growth in the China economy. However, my view is that in November, china stocks will start to see the effect of the reduced interest rates.

Companies may see more contracts coming in, and old customers being able to pay up for existing contracts.

One example:

Hu An Cable clinches RMB101.3 million contract

- Group to supply low-voltage aerial bundled cables in largest contract to date with long-time client, Hubei Province Electric Power Company.

- Ability to secure large contract from provincial power grid demonstrates Group’s increasing reputation outside of its home base, Jiangsu province.

- Group expects more projects of such scale in coming years.

Source:

http://huancable.listedcompany.com/newsroom/20120703_173059_KI3_4D604984906FD28548257A3000335658.1.pdf

Friday, June 8, 2012

Volatile Market

SGX is in a very volatile position given the problems of the European Debt crisis involving Spain and Greece. Investors are speculating of a Greece exit on euro and Spain's debt problems, causing uncertainty in the markets.

China's still slowing on on growth had now decide to cut its interests rates from ~6% to ~3%. However it is still a question on whether companies with their tight financial position will tap onto the lower interest rates.

China's still slowing on on growth had now decide to cut its interests rates from ~6% to ~3%. However it is still a question on whether companies with their tight financial position will tap onto the lower interest rates.

Thursday, May 17, 2012

Despite Facebook's IPO, I am bullish on 3 other tech stocks

According to CNBC's interview, Facebook do not need the money from its IPO. Apple is holding about 100B in cash and yet to spend on something.

CNBC's interview also states that Facebook will go more into mobile.

Therefore i'm bullish on 3 tech stocks that will grow with the abundance of cash these tech giants will spent on.

Harddisk Stock - To support Apple on cloud storage expansions and to facilitate the increase of facebook users.

Monday, May 14, 2012

Friday, May 11, 2012

Wednesday, May 9, 2012

Silverlake, a hidden gem

Silverlake is one of my favourite companies to invest in. They released their 3Q12 ending 31 Mar 12 yesterday and posted a Revenue increase of 21% and net profit increase of a whopping 63%.

About Silverlake

Silverlake Axis Ltd (SAL) is a leading provider of digital economy solutions and services for major organisations in Banking and Financial Services,

Payments, Retail and Logistics businesses. The Group's Silverlake Axis Software and Services Solutions are delivering operational excellence and

enabling business transformations at over 100 organisations across Asia including 40% of the top 20 largest banks in South East Asia.

Their Products

Subscribe to:

Posts (Atom)

.jpg)