One of the blogs i read was a person who is a long term investor of Kingsmen Creative. Below is what he gathered from the 2012 AGM.

financiallyfreenow (2012) says

- "One shareholder asked about the competitors of Kingsmen. Benedict Soh, the co-founder and Executive Chairman, said that the competitors vary for each division. He also said something very significant. He said that Hans Bruder, Managing Director of Octanorm, told him, “No other company in the world has the same breadth of services as Kingsmen”. I felt elated at hearing this. Ben joked that now he has someone to quote instead of him always saying that Kingsmen is a strong company.

- 70% of Kingsmen’s clients are repeat customers. Ben said that clients come back to Kingsmen just like how patients always visit the same family doctor for illnesses. Word-of-mouth recommendations have also helped Kingsmen’s business.

- Revenue contributions from Singapore takes a huge percentage of total revenue. Many of the projects done overseas are still billed in Singapore as the Singaporean teams are involved in the project overseas even though the clients are overseas clients."

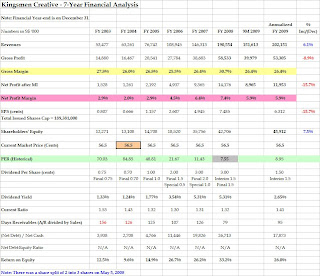

These 3 points indicate that Kingsmen business is fundamentally sound, meaning to say that their business is resilient to competitions but does not mean that they are not exposed to competitions at all. I do not have a very detailed overview of this company but based on the numbers from recent years, the company had substantially grew their revenue at a steady pace. Next is the quote from sgmusicwhiz, who is also believes greatly in its strong business fundamentals.

sgmusicwhiz (2012) says "Kingsmen’s revenues have seen a steady rise from S$53.5 million in FY 2003 to a high of S$190.6 million in FY 2008, in just a span of 5 years. 9M 2009 revenues were S$151.6 million, and as 4Q is traditionally their strongest quarter, the FY 2009 results may yet surprise on the upside."

CNBC with Wires (2008) says "Financial institutions globally have recorded more than $500 billion of write-downs and credit losses as the U.S. subprime mortgage crisis has spread to other markets." with context to the Lehman Brothers bankruptcy issue caused global investors worldwide to lose confidence, meaning to start withdrawing out money from their investments from bonds, equities, banks etc. This in turn caused a market turmoil. Investors worldwide being fearful, decided to stop spending/investing and soon more and more businesses got affected.

However, if you look closely at the earnings from Kingsmen Creative at the 2008-2009 mark during the turmoil, their revenue was not at all affected. This shows that the company is resilient because it is able to deliver earnings with the presence of an economic crisis.

Now with the Price to Earning(PE) ratio of ~9 is still a cheap buy for this stock.

CNBC with Wires (2008) says "Financial institutions globally have recorded more than $500 billion of write-downs and credit losses as the U.S. subprime mortgage crisis has spread to other markets." with context to the Lehman Brothers bankruptcy issue caused global investors worldwide to lose confidence, meaning to start withdrawing out money from their investments from bonds, equities, banks etc. This in turn caused a market turmoil. Investors worldwide being fearful, decided to stop spending/investing and soon more and more businesses got affected.

However, if you look closely at the earnings from Kingsmen Creative at the 2008-2009 mark during the turmoil, their revenue was not at all affected. This shows that the company is resilient because it is able to deliver earnings with the presence of an economic crisis.

Now with the Price to Earning(PE) ratio of ~9 is still a cheap buy for this stock.

Reference List

CNBC with Wires, 2008, Lehman Brothers Files For Bankruptcy, Scrambles to Sell Key Business, viewed 2 September 2012

<http://www.cnbc.com/id/26708143/Lehman_Brothers_Files_For_Bankruptcy_Scrambles_to_Sell_Key_Business>

sgmusicwhiz 2012, Kingsmen Creatives Analysis of Purchase, viewed 2 September 2012

<http://sgmusicwhiz.blogspot.sg/2010/03/kingsmen-creatives-analysis-of-purchase.html>

financiallyfreenow 2012, Kingsmen Investment Fair 2012, viewed 2 September 2012

<http://financiallyfreenow.wordpress.com/2012/05/19/kingsmen-annual-general-meeting-fy-2011/>

.jpg)

No comments:

Post a Comment